Maximum Mortgage Amount $20M

Free lawyer fee , Free valuation fee

HOS/TPS Home Owners are applicable

No Title Deed , No Collateral Required

Long Tenor Period

Up to 120 months

Lower Interest Rate than Personal Loan

Annual interest rates starting as low as 12%

PROPERTY

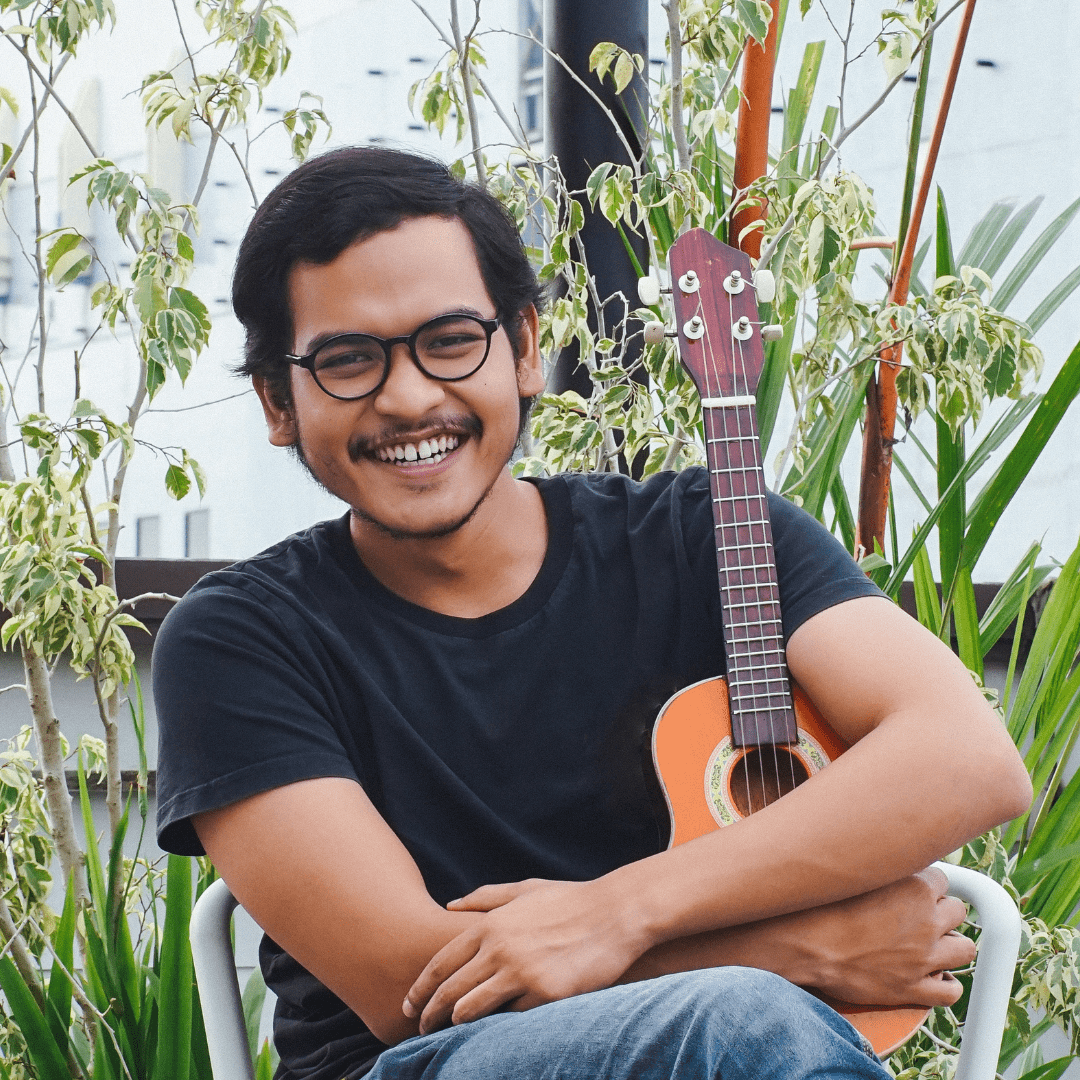

Transforming Destiny

Flexible cash-out options

We strive to get you the highest property valuation, along with the most favorable mortgage interest rates and rewards, making it easy for you to apply for a property loan.