Just 4 Simple steps to Apply for a Second Mortgage and

Unlock your property's potential!

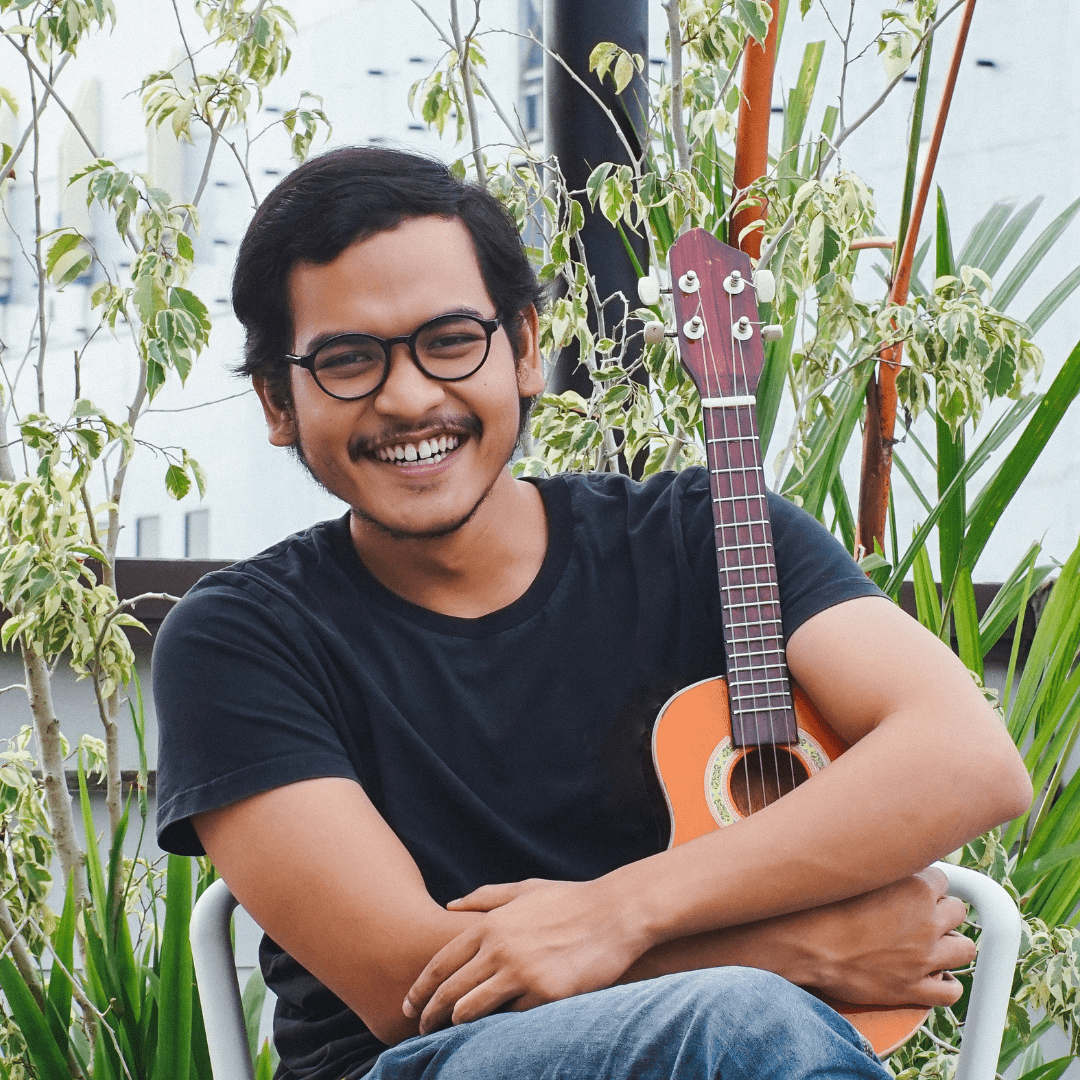

Don’t let Hong Kong’s property market leave you behind. Second mortgage companies like Credit KO can help you unlock the equity in your property and achieve your financial goals. Here’s how to do it: